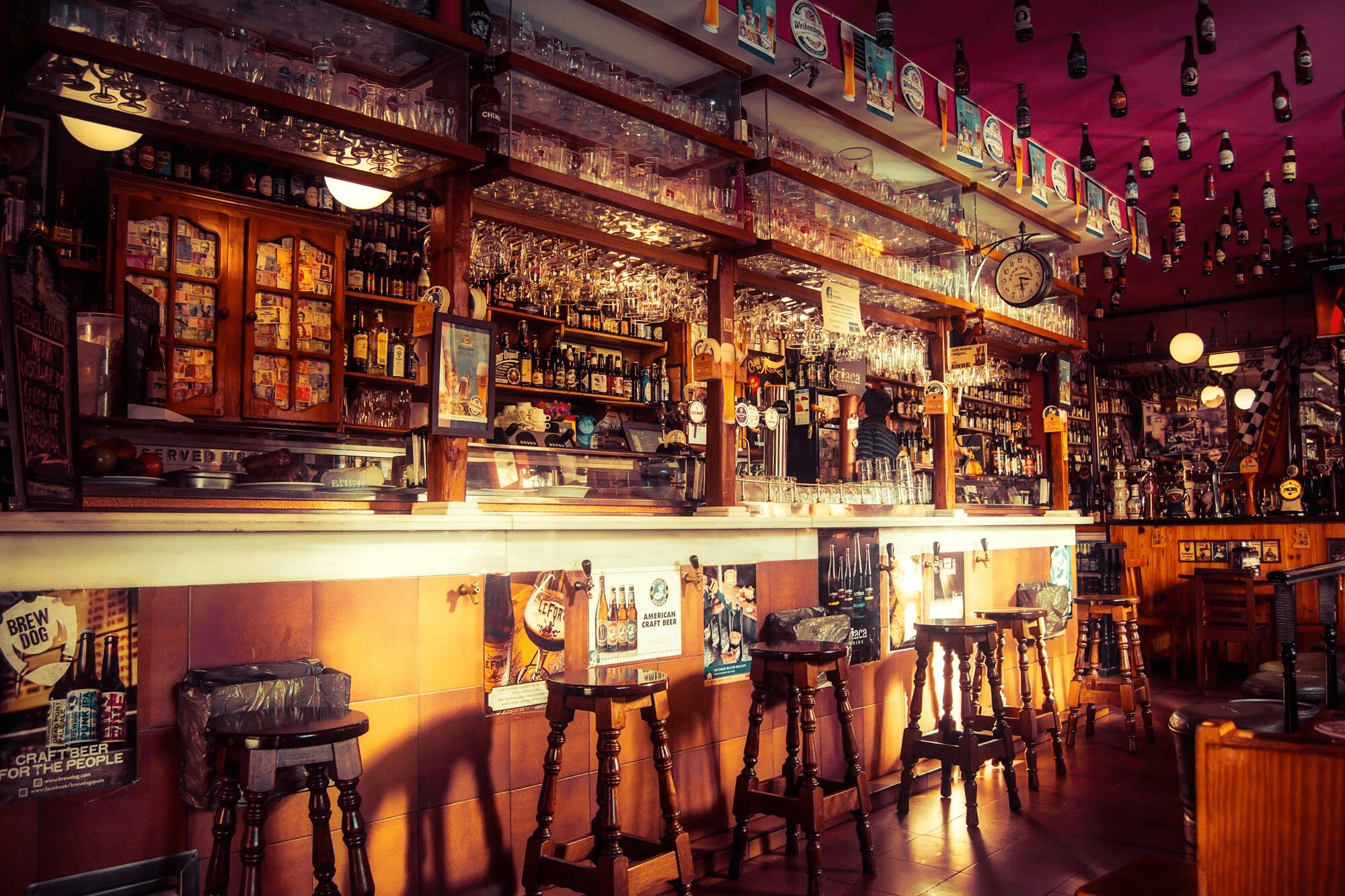

Running a small bar or restaurant comes with its unique set of challenges and risks. From property damage to liability issues, the unexpected can happen at any moment.

This is where the value of insurance becomes undeniable. Here’s a look at the key benefits of investing in insurance for your small bars or restaurants.

Protection Against Property Damage

Investing in comprehensive insurance is essential for the safeguarding of your establishment’s physical assets. Property protection insurance mitigates financial losses caused by unforeseen events such as fires, floods, or vandalism.

This coverage ensures that the monetary impact of repairing or replacing damaged property is not borne out of pocket, thereby securing the operational continuity of your bar or restaurant.

Such a strategic approach to risk management not only protects your capital investment but also provides peace of mind, allowing you to focus on business growth and customer satisfaction.

Liability Coverage

Liability coverage is like having a safety net. If someone gets hurt in your bar or restaurant or if you get blamed for someone’s property getting damaged, this coverage helps you pay for those problems. It means if an accident happens, you won’t have to pay all that money from your pocket.

Sometimes, things can go wrong, like a customer slipping on a wet floor or getting sick from food. Liability coverage can protect you from big bills when these bad things happen. It’s really important because it helps keep your business safe and sound, so you don’t get into money trouble.

Business Interruption Insurance

When bad things happen, like a fire or a big storm, and your restaurant has to close for a bit, Business Interruption Insurance helps. It’s like a safety net. Imagine your place is shut and you’re not making money.

This insurance can pay you the money you’re missing out on. It helps cover bills and pay your workers, even when no customers can come in. This is a big part of restaurant insurance because it keeps you safe from losing a lot of money when things go wrong.

Liquor Liability Protection

Liquor liability protection is super important for bars and restaurants that serve drinks. It’s like a special helper that keeps you safe if something not-so-good happens because someone had too much to drink at your place.

Imagine someone drinks a lot at your bar, then drives and causes a car accident. If people think it’s your fault because you served them too much drink, they might want you to give them a lot of money.

But if you have Liquor liability protection, it can help pay for these problems. It’s like having a big shield that helps protect your bar or restaurant from big trouble and lots of money problems when alcohol is involved.

Worker’s Compensation

Worker’s compensation is a special kind of insurance that helps when your workers get hurt or sick because of their jobs. Think if someone who works for you falls and gets hurt, or if they get sick from something at work. This insurance helps pay for their doctor visits and gives them money if they can’t work for some time.

It’s good because it helps take care of your workers and also protects your business. You don’t have to worry much about paying a lot of money if someone gets hurt or sick from working for you.

Food Contamination Insurance

Food contamination insurance is super important for keeping your bar or restaurant safe. Imagine you have food that gets bad because of germs or something else yucky. Or maybe your fridge breaks down and all the food inside goes to waste.

This kind of insurance helps pay for the cost of throwing away the bad food and getting new, good food so you can keep serving your customers. It can also help pay for cleaning up so everything’s safe and healthy again.

Plus, if you need to say sorry to customers or tell them what happened, it can help with that too. It’s like having a backup plan to keep your food yummy and safe for everyone.

Customizable Insurance Packages

Choosing the right insurance for your bar or restaurant means finding a package that fits like a glove. Customizable insurance packages allow you to pick and choose the types of coverage that make the most sense for your specific needs.

Whether it’s dialing up your liability coverage, adding extra protection for outdoor dining areas, or securing a more comprehensive property damage policy, these customizable options ensure that every corner of your business is protected. It’s about creating a safety net that’s tailored just for you, ensuring that you only pay for what you need.

Risk Management Support

Beyond just offering financial protection, many insurance providers also offer valuable risk management support. This includes access to resources and advice on how to make your bar or restaurant safer and how to avoid common pitfalls that lead to claims.

From training staff on safety practices to evaluating your property for potential hazards, risk management support can play a crucial role in preventing accidents before they happen. It’s not just about having a safety net for when things go wrong, but also about building a stronger, more resilient business foundation.

Employee Training Programs

Investing in employee training programs as part of your insurance package can pay dividends in the long run. These programs can teach your staff how to handle food safely, serve alcohol responsibly, and manage emergencies effectively.

Skilled, knowledgeable employees not only contribute to a smoother, safer operation but also lessen the likelihood of incidents that could lead to insurance claims. Through these programs, your team can become your most valuable asset in maintaining a safe, welcoming environment for your customers.

Find the Best Insurance for Small Bars

In simple words, picking the right insurance for your small bars or restaurant is super important. It’s like having a big, strong safety net that keeps you, your place, your workers, and your cash safe when things go wrong. You got to have it, so you don’t get into big trouble or lose lots of money when bad stuff happens.

Plus, you can make it fit just what you need, so you’re not paying for stuff you don’t. And hey, you even get help to not have so many problems in the first place. Find the best one, and you’re all set to keep your place running smoothly and safe.

Did you find this article helpful? Check out the rest of our blog.